Services

Begin with the End in Mind means to begin with a clear vision of your desired direction and destination.

– Dr. Stephen R. Covey

– Dr. Stephen R. Covey

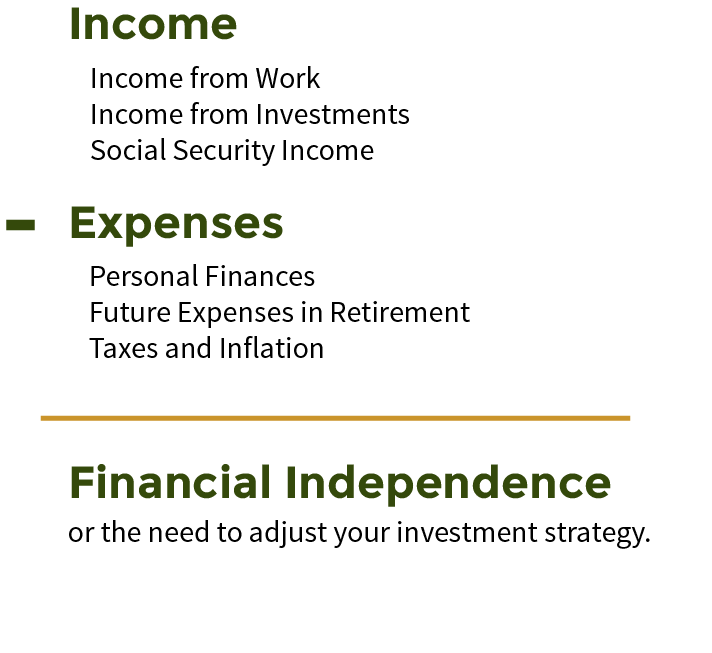

Financial Independence Equation

Having a recurring and sustainable income greater than one’s expenses.

Strategic Assessment

At PanthRex, our goal is simple… to deliver you with exceptional service and an experience unparalled in the industry.

PanthRex advisor representatives are required to follow the CFP Board’s standardized six-step process, a system designed to: Identify and Prioritize your goals and timelines – Collect all information necessary to make informed decisions – Assess and Analyze – Design a plan using a prudent process to achieve predetermined objectives – Implement proposed strategies – and Monitor the plan’s performance on a continuous basis.

1. Communication

We begin by listening. We listen to truly understand your goals, objectives, and dreams while balancing them against your fears and concerns. We take the time to get to know you and what moments in life bring you joy and happiness.

2. Identify and Understand

We strive to identify and understand what is important to you. PanthRex uses the LifeArcPlan™ Personal Information Survey to collect and archive your responses to questions designed to identify personal goals, concerns, expectations, timelines, and finances throughout your pre-retirement, retirement, and distribution phases.

3. Assess and Analyze

We use a consultative approach. We believe in meeting the client’s needs through a multi-disciplinary approach, consisting of legal, tax, investment, insurance, and financial planning, all working together for the client’s best interest. Our clients deserve more than a one dimensional approach. Our goal is to identify the interdependency of each ‘piece of the puzzle’ and how it works with or impacts the other aspects of the overall plan.

4. Design the Plan

We begin with the end in mind and develop an approach based upon the client’s personal risk assessment. Our belief is that a prudent approach to investing is to only expose the client’s investment to the amount of risk necessary to achieve the short-, mid-, or long-term investment objective.

5. Implement Unified Solutions

We build customized investment portfolios. An investor’s portfolio may include equities, bonds, insurance products, cash equivalent, or a combination of these options. By taking a prudent approach to determine the optimal mix between at-risk and safer money solutions, we protect you, the investor, from overexposure to adverse market conditions.

6. Monitor

We utilize cutting-edge technology to continuously monitor and report portfolio performance. From our landing page, our clients can access their client Information 24/7. We provide our clients with access to our team, the account custodian, and to the performance software with just a couple of clicks.